Money Management

How Students Pay for Their Courses

Students at Delaware County Community College can obtain bills and receipts from Enrollment Central or through delaGATE. Students can pay their bills using cash, checks, electronic checks, debit cards, credit cards, and traveler’s checks. Payments may be made via delaGATE.

Opening a Bank Account

Students interested in opening an account that would feel more comfortable having more information are welcome to make an appointment with an international student staff member. Be sure to read over all of the information you receive: different banks charge different fees for certain services. Choosing a bank is a personal decision: the College cannot be responsible for final selections or account management.

Checking Accounts

Opening a checking account will provide a method for wire transfer of funds. Checks, (or electronic payments from the checking account), can be used to pay monthly bills like those for rent, telephone, and electricity. Be sure that there is enough money in your account to cover the amount of the check when the check is expected to be cashed, or the electronic payment when the payment is expected to be made.

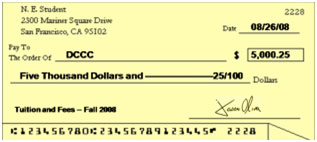

Writing a Check

Remember to sign and date all of your checks. Your address goes in the upper left hand corner of the check. Here is an example of a check that is already filled out:

Automatic Teller Machines (ATMs)

Basic banking, such as deposits, transfers and withdrawals, is available 24 hours a day at an ATM. These machines can be found throughout the U.S. An ATM is located outside of the cafeteria and inside the Café on the Marple Campus. One should only use machines located in a safe and secure place, and avoid making withdrawals after dark.

Credit Cards

Credit cards are popular, but are sometimes difficult to obtain for international students who have not established good credit in the U.S. Students are advised to obtain an internationally accepted credit card from their home countries when possible. Major credit cards include Visa, MasterCard, American Express, and Discover. Be wary of using credit cards as a means of postponing payment for purchases. Almost all credit cards charge interest, which may range from a small percentage to a high percentage (e.g. 25%) charge on purchases. If your credit card is lost or stolen, file a report with the police and notify the company that issued the card immediately.